The impact of COVID-19 and Halving on the cryptomarkets

Within only the last few months, Covid-19 has managed to destroy and destabilize the world, endangering not just lives, but economic borders and well-established multinational corporations. The crypto markets is no exception to the negative impacts that the Covid-19 pandemic brings as the market faces violent swings in prices. The crypto markets have been seen steadily crumbling under the strain of the pandemic, with panicked investors rushing to liquidate their crypto assets in massive selloffs stemming from unprecedented BTC crashes. Massive percentage declines are seen within a short period of time, causing even global exchanges including Bitfinex to start delisting trading pairs in attempts to resuscitate ailing liquidity. In addition to the pandemic, with the recent halving event cutting the number of BTC entering circulation by half, the markets are thrown into turmoil once again with erratic price predictions and investor sentiments.

Strong signs of recovery in the crypto exchange landscape

How severe is the negative impact of covid-19 on the cryptomarkets exactly? The top two traded cryptocurrencies, Bitcoin and Ethereum, were heavily hit by the Covid-19 pandemic as prices plunged. Bitcoin, which had just hit the $10,000 mark on 10th February, a feat that was celebrated by investors at that point as they hoped for the prices to continue soaring. However, its prices severely plunged and faced a decline of 26.2% within March itself, along with Ethereum experiencing a significant drop of 39.06%.

To shed positivity on the current situation, the crypto markets have started to show subtle signs of recovery. Despite the extreme volatility, Bitcoin, as well as other major cryptocurrencies, have started to stabilize. Within the last 24 hours, Bitcoin has surged past the $9,000 after the halving event (Correct as of press time – May 14, 2020). Even Coinbase, one of the world’s most major spot crypto exchanges, was facing technical difficulties trying to cope with the increased attention towards investors flocking back with larger-than-usual buying volumes.

If you are a crypto exchange reading this, chances are that liquidity might be your biggest concern during this unprecedented market upsurge. In this article, discover how you can position your exchange to successfully leverage on this bull run. As a leading liquidity provider within the FX industry for over a decade, we are no strangers to solving even the most complex liquidity issues.

Fuelling the future of liquidity with NEXUS 2.0

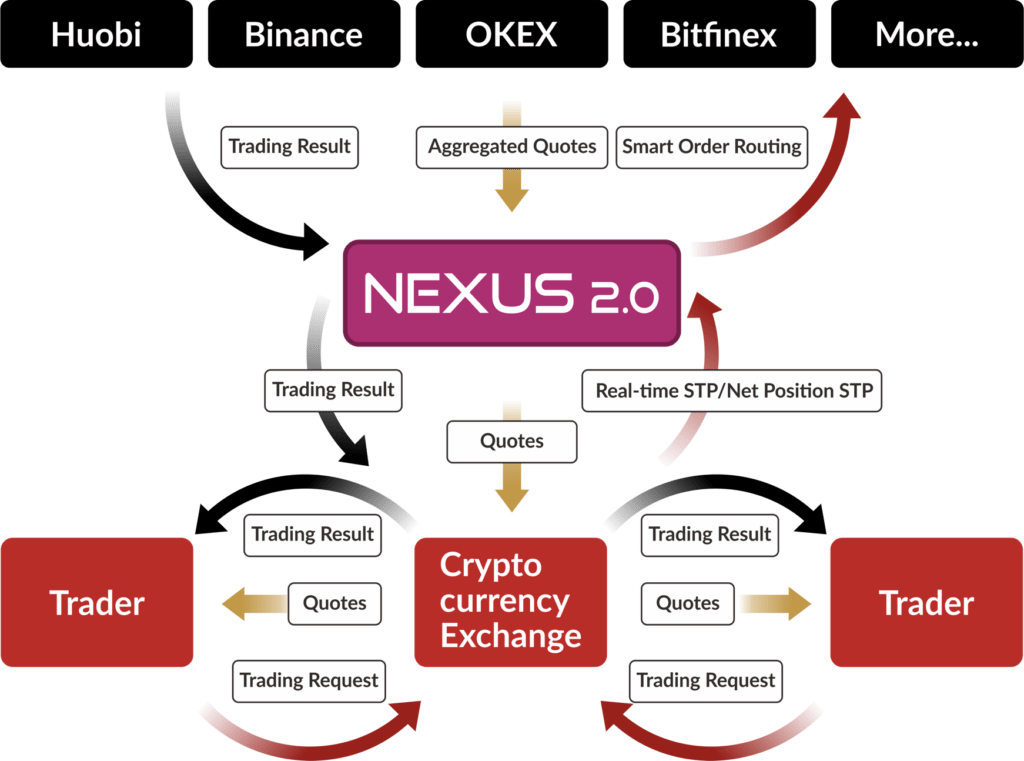

Broctagon’s proprietary NEXUS 2.0 liquidity aggregator combines price quotes from top crypto exchanges such as Huobi and Binance directly into your exchange orderbook via smart order routing. This consistent circulation of quotes empowers exchanges to achieve the best bid and sell prices for their traders without going through the hassle of manually comparing prices against multiple price feeds.

Upon trade confirmation, orders are automatically allocated to the best-priced exchange through real-time/net position STP (Straight Through Processing) functionality to ensure instant communication between relevant counterparties.

What this means for your exchange is that your traders will effectively trade across multiple exchanges through a single avenue – your exchange. They will have round-the-clock access to the fairest trades at the best market prices, regardless of illiquid market circumstances.

“Our clients will experience seamless STP execution, automated feed switching mechanisms, improved orderbook market depth and enhanced candlestick charts with higher tick frequency.” – Don Guo, CEO of Broctagon

The difference with NEXUS 2.0

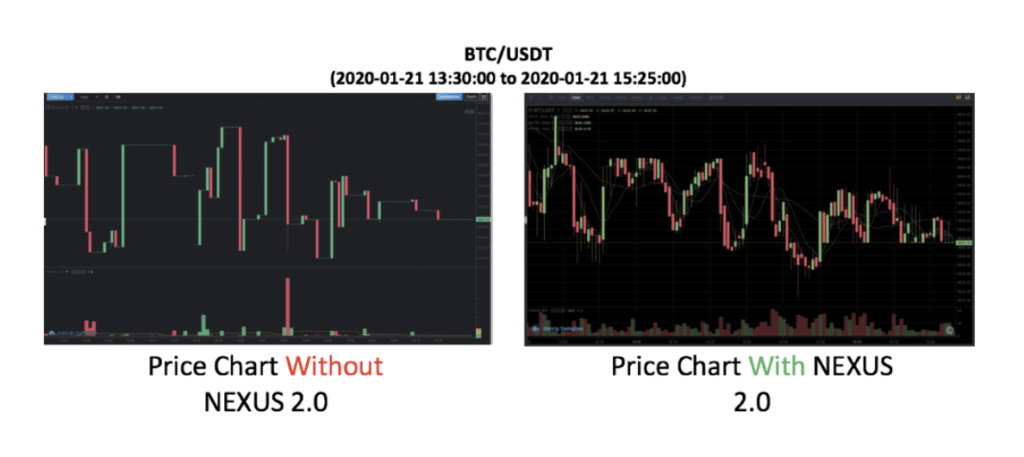

With NEXUS 2.0, your orderbooks are populated and your candlestick charts are dynamic. As shown in the above example, NEXUS 2.0 provides visible heightened activity, with higher tick frequency. The regular chart movements signal reliable past trends and heavy user participation, giving traders the confidence to join your exchange, knowing that it is healthy and active with a robust demand and supply.

With NEXUS 2.0, you can:

Aggregate multiple top sources of liquidity into one orderbook.

Achieve consistent real-time best bid best offer price quotes.

Ascend your business to globally competitive levels.

Elevate your exchange with liquidity for every opportunity

There is no better time to get your exchange battle-ready than now. In such times of crypto volatility, your traders are trying harder than ever to secure the best prices for their cryptocurrencies. With our industry’s first crypto STP built for exchanges, experience instant liquidity and unparalleled market depth to exceed the expectations of your users. Rather than sourcing for liquidity by yourself, schedule a demo with our experts and discover why NEXUS 2.0 is your exchange liquidity solution.

Get in contact with our liquidity experts via https://broctagon.com/contact/ to start now!